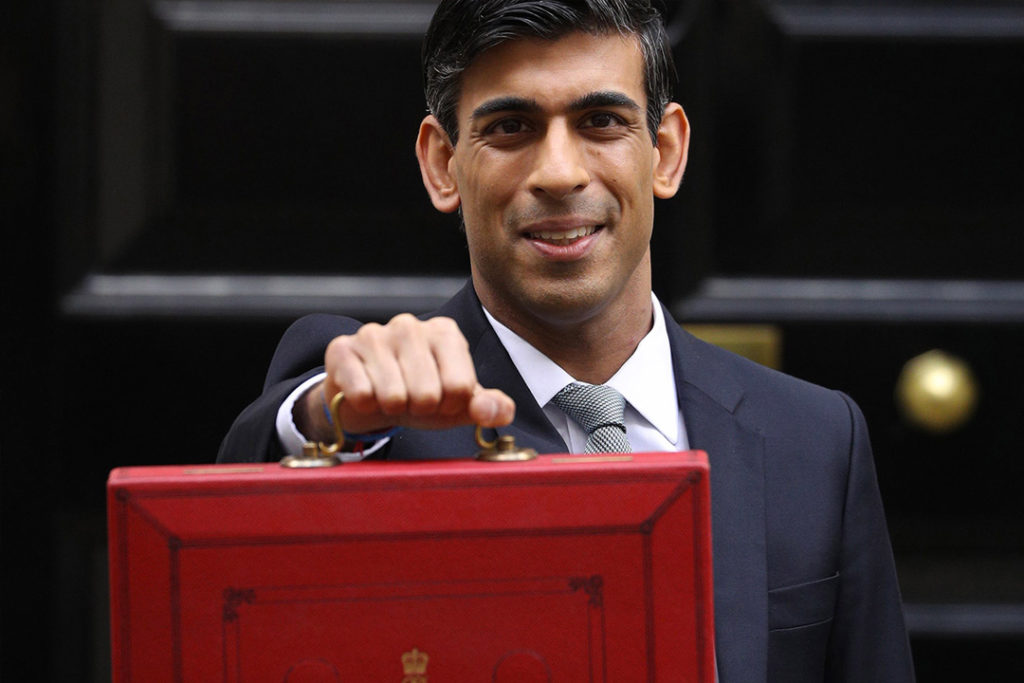

BUDGET 2021

The Chancellor of the Exchequer Rt Hon Rishi Sunak MP delivered his second budget on 3 March 2021. Here is a summary of some of the announcement.

CORONAVIRUS SUPPORT

Furlough extended

Sunak began with announcing his extension of the furlough scheme to the end of September 2021.

Self employed scheme

600,000 more self-employed people will be eligible for help as access to the grants has widened now more people have submitted their 2019/20 tax returns.

£5bn business grants

Pubs, restaurants, shops and other businesses hit hardest by the coronavirus pandemic will be boosted by a £5bn grant scheme to help them reopen – ‘restart grants’ worth up to £6,000 per premises to help non-essential retailers reopen. Hospitality, hotels, gyms along with personal care and leisure businesses will have access to up to £18,000 per premises.

Culture to receive £400m additional support helping museums, theatres and galleries in England.

VAT cut

The reduced 5% VAT will be extended to 30 September 21 and after that it will only raise to 12.5% not back to 20% until April 2022.

PROPERTY

Mortgage Guarantee Scheme

The government will offer incentives to lenders to help buyers with a 5% deposit to buy properties with up to £600,000 – available from April.

Stamp duty extended

To help the backlog, the stamp duty holiday will run until the end of June 2021.

More good news…

Help to Grow scheme

Sunak is launching a £520m initiative to support small businesses with training and software. The aim of the scheme is to spark innovation, create jobs and generate prosperity.

Traineeships

£126m is to be made available to create 40,000 additional traineeships across England. There will be £3,000 incentives for employers to take on an apprentice. Apprentices will also be able to work for multiple employers through a new ‘flexi-job’ apprenticeship, from July employers will be able to bid for money from a £7m fund to create new agencies, with the first flexible apprentices expected to start in January 2022.

BUSINESS

Corporation Tax

It was widely thought that the Chancellor would raise this lucrative tax… from 2023 there will be a new tapered rates of 19-25%. Businesses with profits more than £250,000 will be taxed at the full 25% rate, Companies with profits less than £50,000 will remain at 19%.

Duties

Alcohol and fags duty freeze. No increase on fuel duty.

Taxpayer Protection Taskforce

A dedicated unit will be formed to crack down on Covid-19 fraudsters. The unit will consist of 1,250 staff and funded with £100m to hunt down fraudsters conning people and the Treasury. Currently HMRC has c10,000 open inquiries into suspected Covid fraud with some prosecutions already underway.

Honest with the British public

Total borrowing in peacetime is at a record of £355bn this year. The Chancellor says the government will take a “fair” approach to “fixing the public finances”.